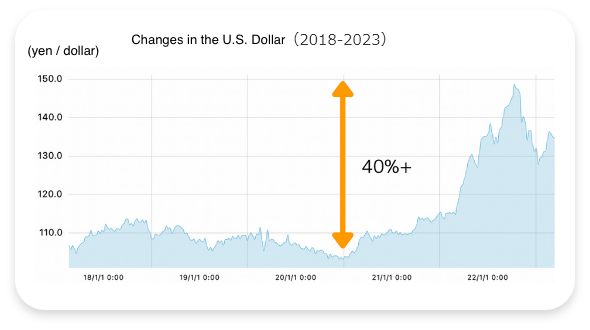

Want to stabilize performance regardless of exchange rates.

Importing products from overseas and selling them in Japan

importing/exporting goods

Sourcing food ingredients from overseas

Imports and exports a wide variety of products.

Utilize cloud servers of foreign companies.

foreign transactions for e-commerce and services

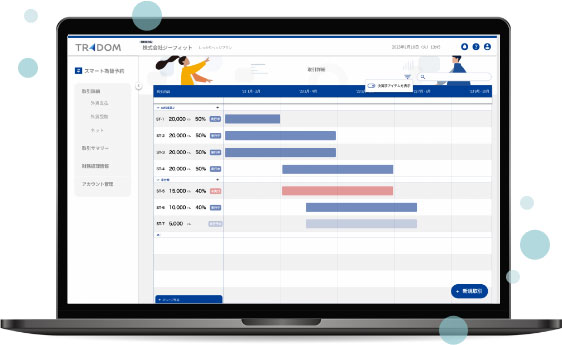

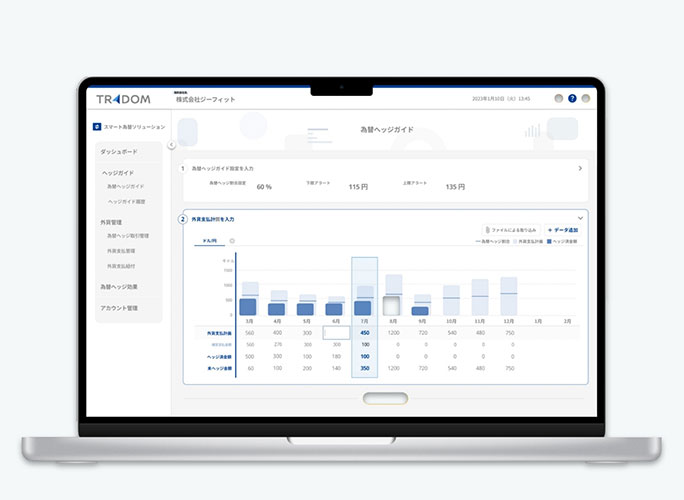

Hedge Guide

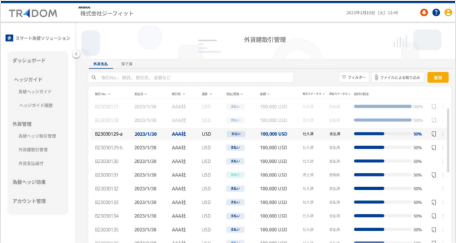

Foreign Currency Management

Governance

Support

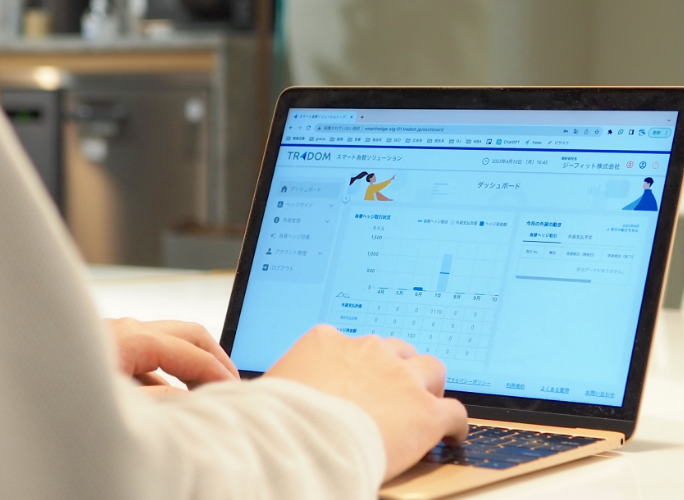

A foreign exchange business support tool offering comprehensive assistance, featuring an AI-driven "hedge guide" for market trend forecasting and a "foreign currency management" function for integrated management of currency transactions and forward exchange contracts.

Want to stabilize performance regardless of exchange rates.

Want to manage complex foreign currencies easily and efficiently.

Want to hedge risk appropriately and focus on own core business.

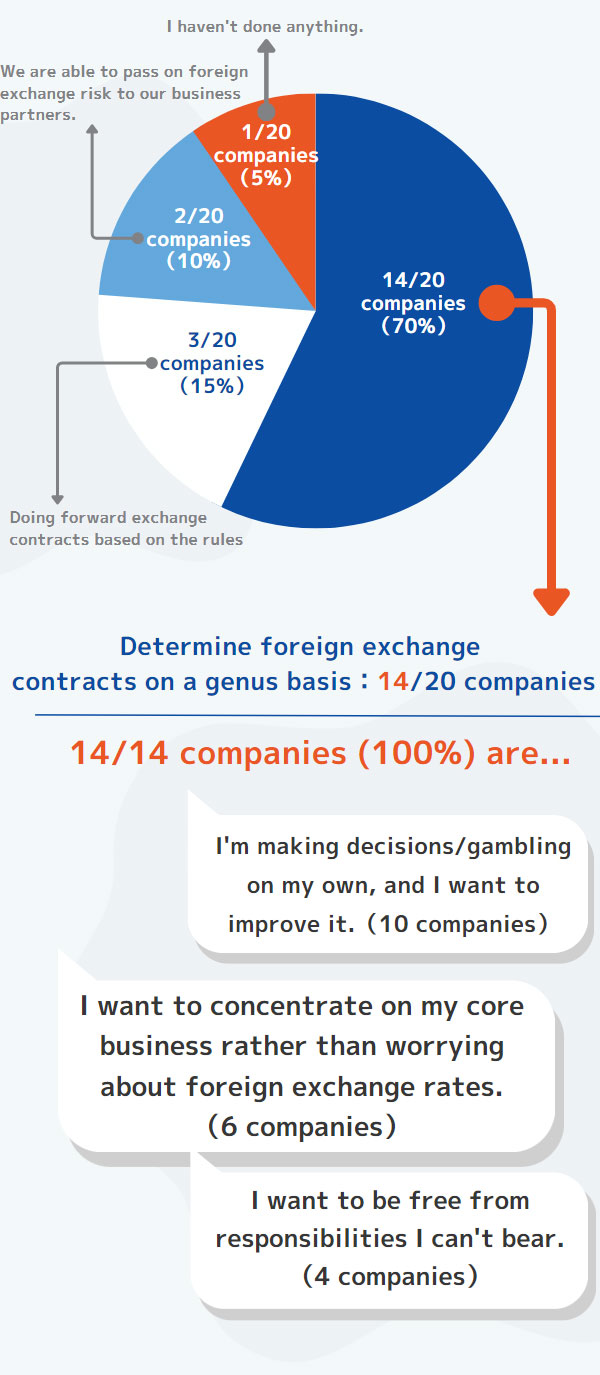

For unresolved issues

Spending too much time/

For unresolved issues

Spending too much time/

Stabilize performance by appropriately controlling foreign exchange risk. Utilize hedging guides aimed at reducing foreign exchange losses.

Appropriate forecasting and management is achieved by separating performance and exchange rate fluctuations.

Improved efficiency of foreign currency management, risk hedging in line with business flow, and other operations that lead to cost reductions.

Effect

Effect

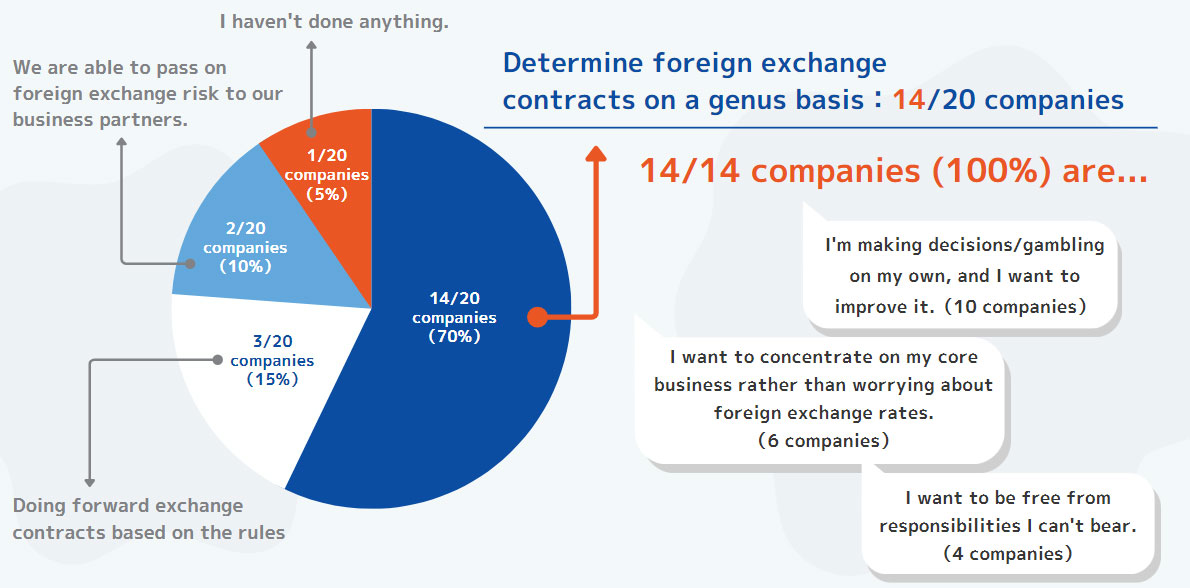

Freeing executives from time and worry spent on currency forecasting

allows senior managers to focus on their core business!

It relieves the individual who is not a currency analyst/expert

from responsibilities that he/she cannot shoulder!

TRADOM's Hedge Guide provides guidance on appropriate currency hedging based on numerous AI-based currency market forecasts. Control your currency risk without worrying about exchange rate trends.

TRADOM's foreign currency management integrates and manages confirmed order information and foreign exchange contracts. It visualizes foreign currency payment/receipt information and its exchange hedging status, making complicated foreign currency management smarter.

TRADOM's Hedge Guide provides guidance on appropriate currency hedging based on numerous AI-based currency market forecasts.

The process is simple.

All you need to do is input "when" and "how much" of your foreign currency payment/receipt is expected to occur from overseas transactions, and the percentage of that payment/receipt that will be hedged.

TRADOM's foreign currency management integrates and manages confirmed order and supply information and foreign exchange forward contracts (*1) to visualize foreign currency payment/receipt information and its exchange hedge status, making complicated foreign currency management smarter.

Information input is easy.

All you need to do is input the necessary information from the order documents and foreign exchange contracts you usually exchange. (*2) Linking of foreign currency payments and forward exchange contracts is also completed instantly.

(*1)Currency options are also supported.

(*2)Information import function by uploading documents is scheduled to be implemented.

to take advantage of our hedging guide and foreign currency management.

| 2026年1月29日 | 雑誌「経済界」3月号にて、弊社代表阪根のインタビューをご掲載いただきました |

| 2025年12月4日 | 株式会社アマダ様に、AI為替リスク管理システム「トレーダム為替ソリューション」を導入いただきました |

| 2025年11月26日 | 日テレ(NNN)に取材をいただきました! |

| To News List | |

We won the JAPANGRANDPRIZE and JETROAward, the grand prize in the domestic category, at "FINOPITCH", a global pitch contest for FinTech startups from Japan and abroad, held on March 10, 2023.